Residential -

Bayleys Canterbury identify residential investment opportunities with incoming legislation

In response to the fast-moving dynamics of the residential investment property market in Christchurch, Bayleys Canterbury is coordinating two large auction days in the coming months – the first taking place at the agency’s Central Christchurch offices in Deans Avenue on July 25, and the second being held at the location on August 29.

Pending changes to the ownership of residential rental properties – combined with the reintroduction of investor-friendly taxation guidelines – are invigorating a niche within Canterbury’s residential real estate sector amongst both purchasers and vendors.

Under the new Government, the restoration of interest deductibility for residential property investor/owners has seen 80 percent interest deductibility brought back from April this year, rising to 100 percent of interest expenses from April 1, 2025. Furthermore, from July 1, changes to the bright-line ownership/sale timeline test will see the period returned to two-years.

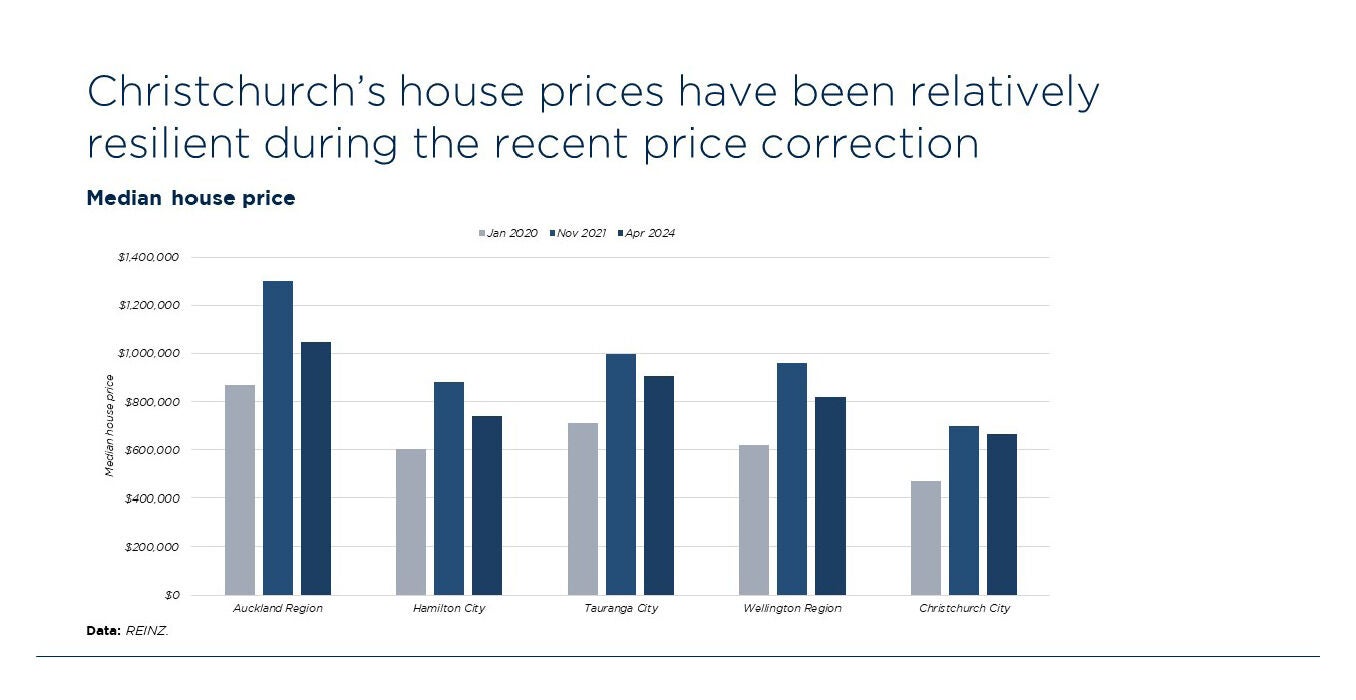

The changes will be warmly welcomed by Christchurch residential property investors who have been buoyed by recent data coming out of the Real Estate Institute of New Zealand, whose figures show that median house prices in Christchurch are the lowest of the country’s five major cities – sitting below the levels of Auckland, Hamilton, Tauranga and Wellington – but showing that Christchurch has had a solid gain over the last four years and there is further room for growth.

Similarly, the REINZ data shows that property values in Christchurch city have fallen only slightly over the past four years - well behind the sale price decline seen in Auckland, Wellington, Tauranga, and Hamilton - showing greater stability and resilience within the market.

Bayleys Canterbury residential investment sales team manager Angela Webb says the dual new ownership and tax regulation changes had motivated the market back into action – effectively balancing out the supply and demand equation for investment category dwellings coming onto the market for sale in the region.

Many investor/owners Bayleys Canterbury has been working with in recent months have been motivated to offload their investment holdings but had been hindered to list their asset for sale during that phase due to the current brightline rules. That scenario is now on the verge of shifting 180-degrees, Over the past five years when residential investment property ownership had been somewhat ‘demonised’ by the previous Government, many investors—both seasoned and aspiring—have been discreetly increasing their equity, anticipating the right moment to either expand their portfolios or start their journey towards owning multiple properties. Following a period of about two years with low market activity, we now find ourselves with a considerable list of potential investors who have been waiting patiently for the perfect opportunity to enter or grow in the market.

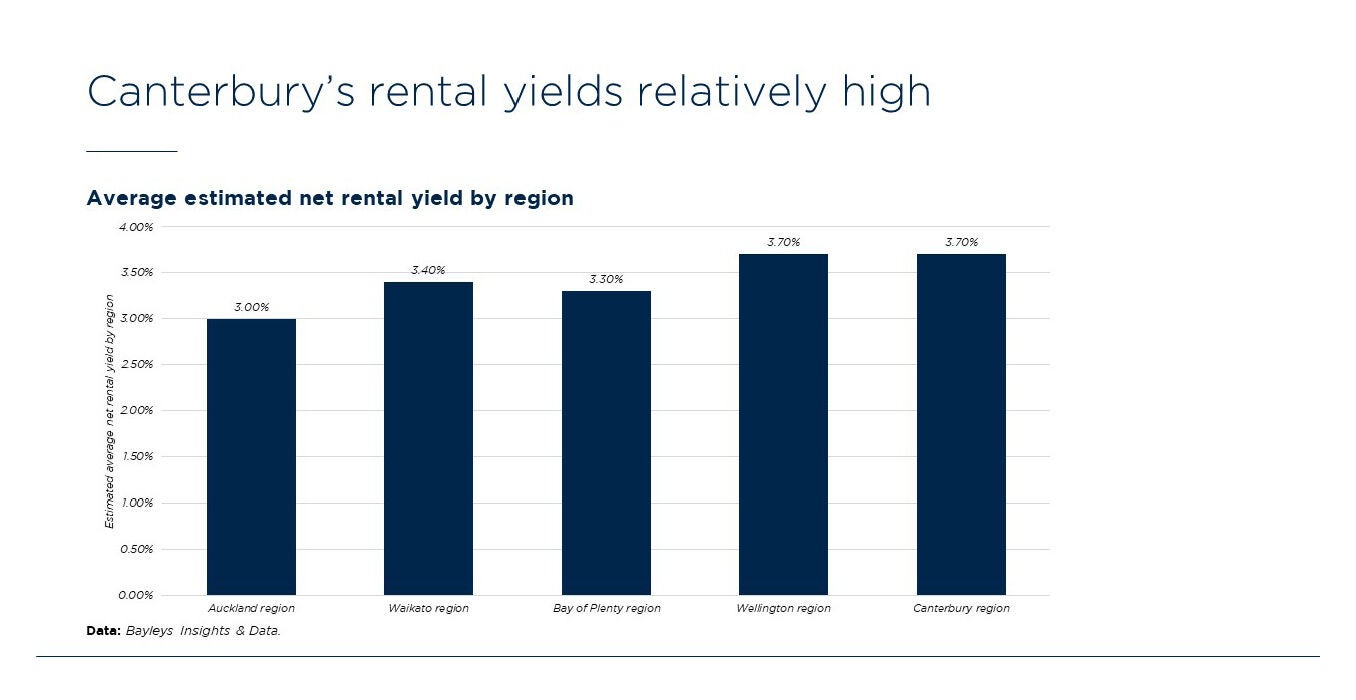

Bayleys Canterbury property management manager Matt Curtis said rental yields in Canterbury were amongst the highest in the country’s biggest cities – coming in at 3.7 percent in line with the level recorded in Wellington, and well ahead of the Waikato region at 3.4 percent, the Bay of Plenty region at 3.3 percent, and the Auckland region at three percent.

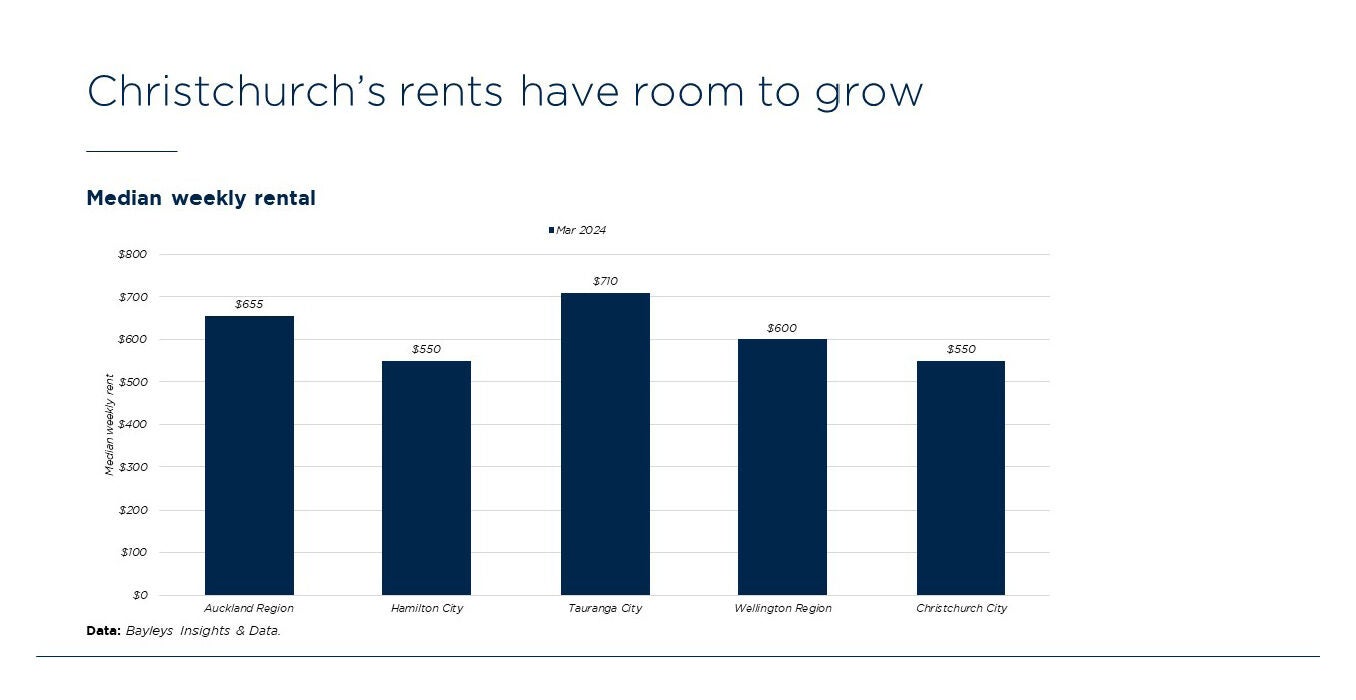

Concurrently, Matt Curtis said that median weekly rental rates in Christchurch were amongst the cheapest of New Zealand’s bigger cities – sitting alongside Hamilton at $550, but well behind the $600 rate being achieved in Wellington, $655 in Auckland, and $710 in Tauranga.

“Those are stat’s and revenue growth opportunities which residential property investors in Christchurch can take heart from – with a raft of rental dynamics available to all categories of investors… from first timers through to experienced investors,” said Matt Curtis.

He said that rental demand was strongest in areas underpinned by education fundamentals.

“For example, we have a lengthy list of family demographic renters looking for three and four-bedroom homes within the Cashmere, Christchurch Boys, and Christchurch Girls high school zones. Families are looking now so that they can be settled in time for the start of the 2025 school year, and they have rental budgets of between $500 - $800 per week depending on room configurations and the condition of the residence,” said Matt Curtis.

“Simultaneously, we are also taking registrations of interest from Canterbury University students looking for accommodation in the Riccarton and Ilam suburbs for their 2025 semester, with the first tranche of property viewings scheduled for next month. With student numbers at Canterbury University increasing year-on-year, the demand for rental properties is even higher.”

For further details go to https://canterbury.bayleys.co.nz/investment-auctions or contact Rachel Dovey at Bayleys Canterbury on 027 268 5550.