Rural -

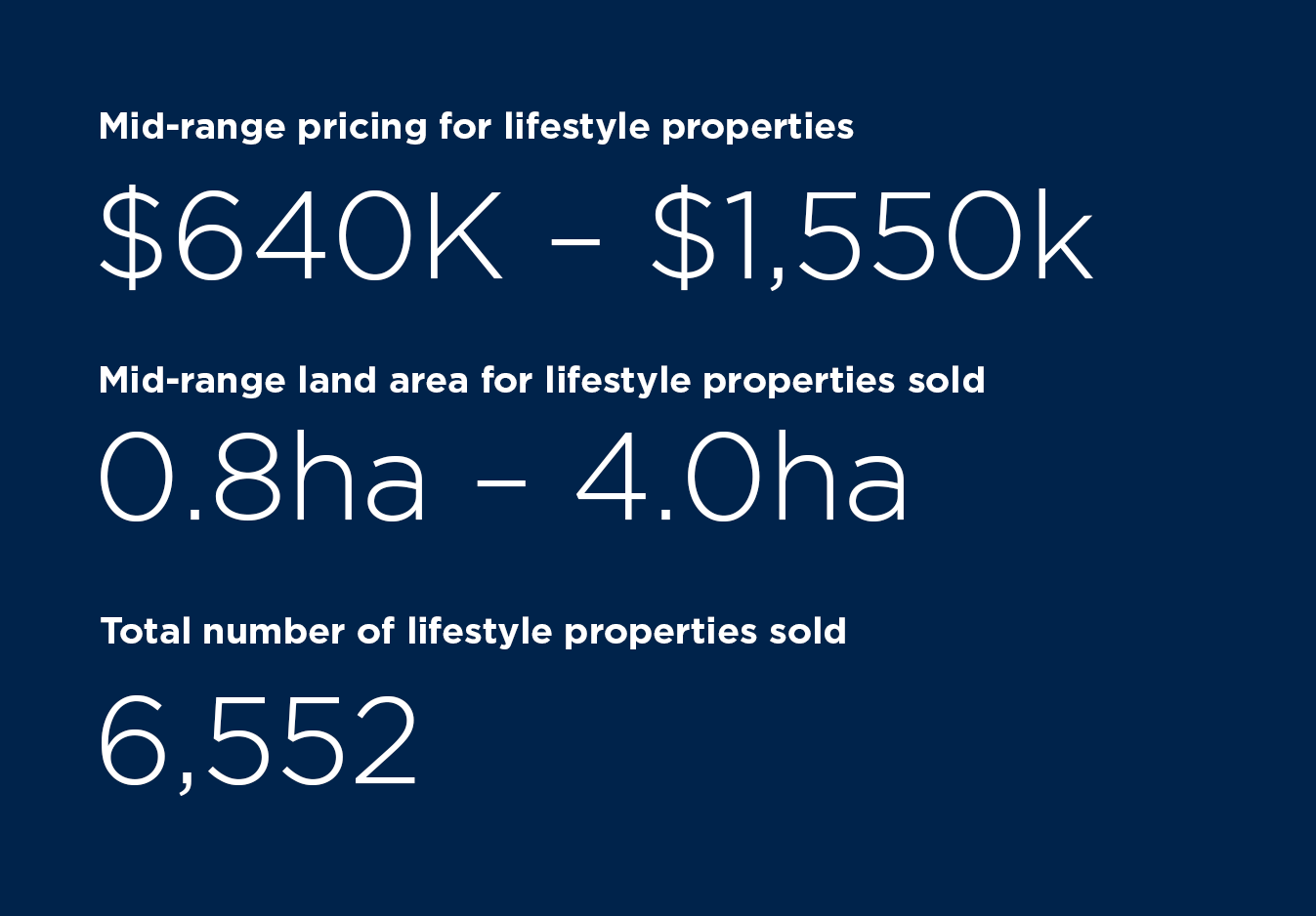

Rural Insight lifestyle market sector report H2 2022

See below for a summary of the biggest trends in the lifestyle market, plus an outlook on the next 12 months.

Biggest trends

Prices calm after a massive boost

Prices calm after two years of year-on-year gains. Sale processes are generally taking longer with more conditional buyers present.

Financing and rising interest rates cause headwinds

Similar to residential properties, ability to secure finance has been impacted by the CCCFA changes and overall affordability has been impacted by increases in interest rates. Buyers are becoming more selective about properties.

Increase in cross-regional activity

Buyers are increasingly looking outside of their local areas, often driven by a desire for a remote working lifestyle change post pandemic. Trend is most apparent amongst Auckland-based buyers who can also benefit from more affordable prices in the regions.

Outlook for the next 12 months

Higher value properties remain attractive

Lifestyle properties with unique and high-spec homes continue to be in demand. Coastal locations and architecturally designed homes, alongside amenities like pools, ponds, ancillary buildings (sheds) and equestrian facilities are particular standouts.

Remote working and connectivity extends buyer reach

A combination of improved connectivity coupled with increased acceptance to accommodate Working From Home has enabled lifestyle ownership for more buyers. The search areas for some buyers are also expanding as they become less sensitive to driving distances.

Impact of government regulations not yet known

The impact of the recently released National Policy Statement for Highly Productive Land remains unclear. Aimed at protecting land used for the production of food, it may reduce subdivision potential for larger rural properties on the urban fringe, constraining the future supply of new lifestyle properties.