Rural Insight -

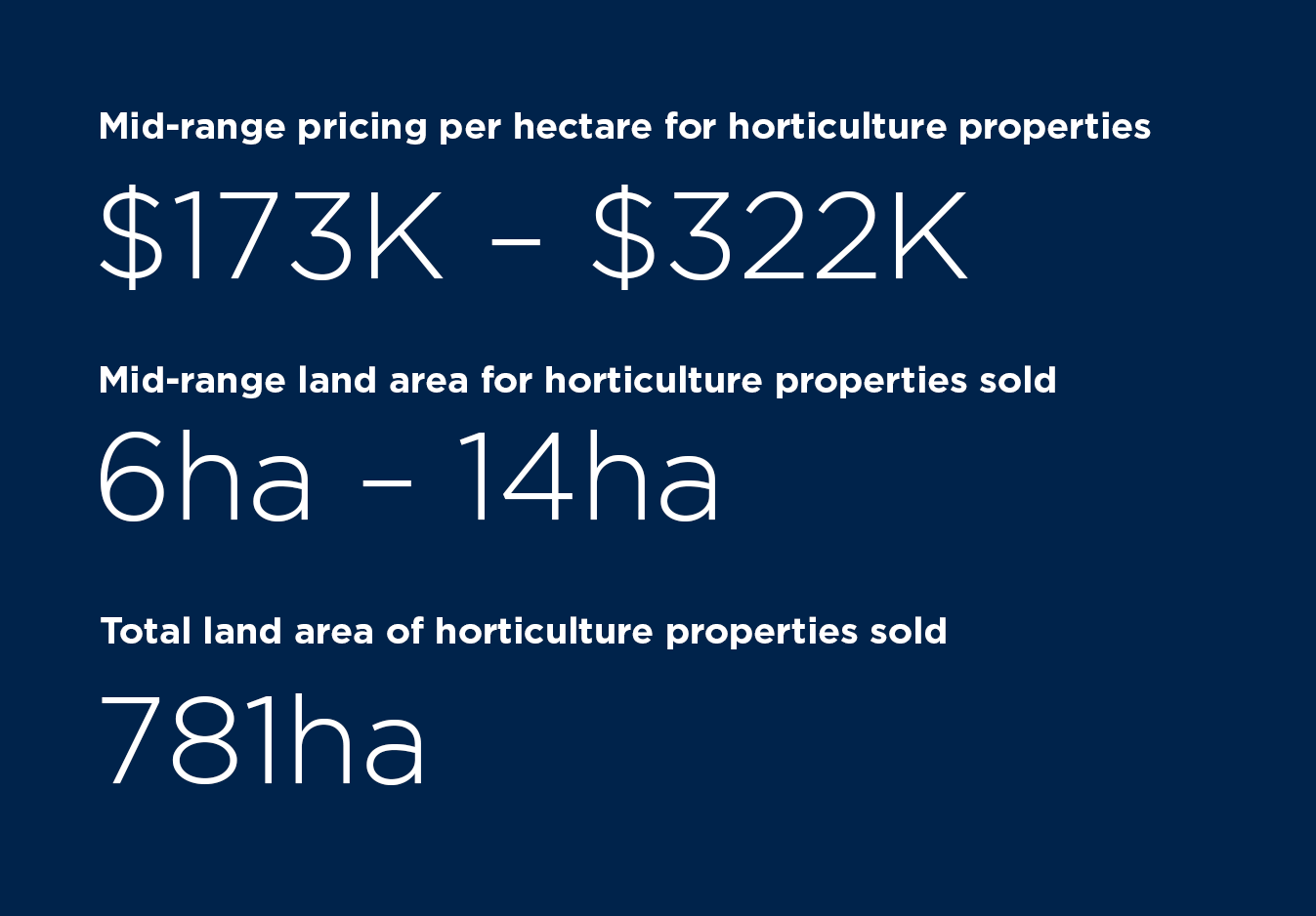

Rural Insight horticulture market sector report H2 2022

See below for a summary of the biggest trends in the horticulture market, plus an outlook on the next 12 months.

Biggest trends

Returns on crops soften this season

Maturing production and sound Orchard Gate Returns (OGR) have built confidence in the market, with strong performance of G3 SunGold Kiwifruit over the 2018-2021 seasons. Fruit quality and packout yields have impacted returns this past season.

Cross sector buyers remain

Buyer interest remains from syndicates, corporates, and existing operators together with an increase in buyers from non-horticulture backgrounds. Ability to outsource operations provides a reasonably passive income stream.

Water is the winner

Without stating the obvious, those with (long term) water access are the winners. Managing expiring consents and the “use it or lose it” approach by regional councils is often critical to preserving production and value of orchard land.

Outlook for the next 12 months

Margins squeezed

While horticulture remains one of the higher returning rural sectors, the hangover of supply chain disruptions and labour shortages experienced this past season, along with rising operating costs onorchard, are expected to squeeze margins.

Values expected to soften after a big boost

Prices for kiwifruit orchards are expected to soften after several year-on-year gains. Sale processes are generally taking longer as buyers undertake more due diligence and time to understand seasonal conditions. Price expectations amongst buyers have softened relative to early 2022, however prices remain elevated compared to pre-pandemic levels.

Opportunity in wider horticulture

The cyclical nature of commodities has impacted avocado OGR. With the industry developing further access to the Asian marketplace this provides buying opportunity.